Why Those ‘Science Projects’ Are Actually Hugely Venture Backable

“The short successes that can be gained in a brief time and without difficulty, are not worth much.’” — Henry Ford

In 2009, when I decided to leave research and academia, I believed the most exciting sciences would be funded by the private sector – and I wanted to be a part of that.

That’s why I became a venture capitalist.

Not to fund the next social app and get rich, but to be a part of an ecosystem that can empower the next golden age of scientific discovery.

And then for the next 10 years, I was told over and over that I wasn’t thinking like a VC because “science isn’t venture backable.” That investment in “science fair projects” doesn’t generate returns on a venture capital timeline.

Like what even is that? Where does it come from?

“Science companies need too much time and capital.”

To address this rhetoric, let’s take a deeper look at Deep Tech, the currently recognized category of science-focused startups. (For now, we’re going to exclude Biotech as a category as these companies exhibit a different growth path. But I’ll have more to say about Biotech in a future issue, because it’s fascinating how different the venture model is there.)

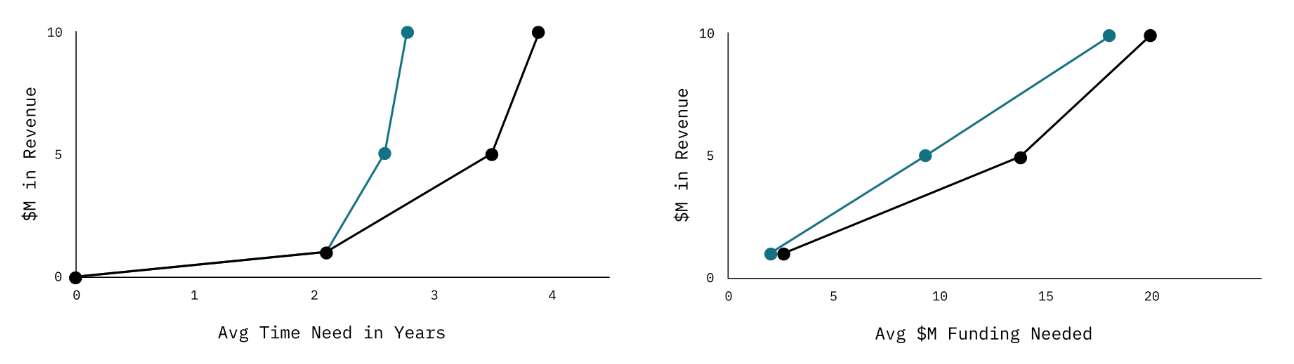

The venture ecosystem has historically avoided the sciences because science-focused companies tend to need more time and capital to exit. The statistic is that Deep Tech startups take an average of 95 months to go from Series Seed to Series D. Regular starts average 75 months – That’s 20 months or 27% longer. However, the gradation rates (or the % of companies who make it to that round) are actually quite similar.

And the biggest deviations predominantly result from the initial phases of company building. Deep Tech startups require more time and capital to reach $10M in revenue. Once the companies reach $10M revenue, the differences start to decrease.

So, what VC should focus on is getting to that $10M revenue goal.

Traditional software-centric startups innovate by focusing on applications of existing technologies. Their approach is to get to market quickly in order to assess product-market fit as early as possible. As a result, software-centric startups are able to get to revenue-generating faster and usually with less initial capital needs.

On the other hand, Deep Tech companies are focused on scientific breakthroughs and/or new ways of applying proven sciences to reality. To do so, these companies have to start with a longer initial R&D period to even bring a viable product to market. 70% of Deep Tech startups hold at least 1 patent, and 83% have some hardware component. As a result, Deep Tech companies require more time and capital before reaching a revenue-generating state.

But here’s the math: “venture-backablility” should factor in not only time & capital to exit, but also exit potential.

And this is where Deep Tech has an edge.

The R&D phase of Deep Tech startups generates proprietary technologies and inventions provide true defensible moats, minimizing competition. Software-centric startups have to focus on growing customer adoption and on racing to maintain a competitive edge, increasing exit risk.

Additionally, Deep Tech startups address market opportunities that are immense (and can create entire new markets), from new energies to new materials to new frontiers.

The numbers are showing this as well. As venture capital has become more available for this sector across all stages, exits for science-related startups are becoming easier and more significant. From 2018-2022 (excluding 2021 year of SPACs), science company exits have skyrocketed to an average of 31 per year with annual value of $30B. In fact, in 2023, 4 of 16 US-based unicorns are science-related.

Numbers don’t lie. Deep Tech VCs are just as good at generating returns as traditional software-centric VCs. The latest shows that Deep Tech VCs have an average weighted IRR of 26%, slightly higher than the 21% of traditional VCs.

And this is just for Deep Tech. Where companies are inventing new sciences and coming up with new ways to apply real sciences – the most science-y and most difficult path. In short, ‘science projects’ can make a f-ton of $$$.

And AI only amplifies this.

As we discussed last week, AI accelerates development through making available greater computational power than ever before, collapsing the time and capital needs for startups to get to market.

And now we’re back to where we left off last week: ScienceTech, or SciTech for short.

Companies that build the software, platforms, or tech-enabled services that accelerate scientific discovery or assist in bringing science to life. In a sense, the SaaS that powers and accelerates Deep Tech.

So, SciTech has the exit potential of Deep Tech. Not only do these companies have defensible, proprietary technology, they also have the potential for shared royalties on IP generated on their platform or with their assistance. And they’re addressing the same massive markets as Deep Tech – markets that could change the world.

And SciTech companies will enable Deep Tech innovation on a SaaS growth path that closes the existing gaps that have scared off impatient investors. They would be able to apply the monetization and go-to-market of current SaaS startups with a timeline to exit that converges with current mainstream startups.

Since venture returns are determined by both time to exit and significance of exit, it would seem like SciTech should be very “venture-backable”

At last, maybe, VCs will start to see the potential.

Next week, we’ll dig into the nascent growth of venture capital funding in Deep Tech and science-related categories – and the problem of “Are we equipped to tell what’s real vs scifi?”

References:

Tech Crunch, "Deep tech exits: Not just science fiction anymore"

EuropeanStartups.co, "2021: THE YEAR OF DEEP TECH"

BCG "An Investor's Guide to Deep Tech"

BCG "Deep Tech: The Great Wave of Innovation"

Dealroom.co "The European Deep Tech Report 2023"