“Nothing in life is to be feared, it is only to be understood”

It's been a little over 9 months since my last post on LinkedIn.

First, a long overdue thank you to the upswell of support. Support that was overwhelming, unexpected, and encouraging.

Thank you to each and every one of you who reposted, commented, and messaged me.

It truly means so much.

The last nine months. To say I was finding myself, would sound cliche.

The last decade has been just a constant blur of "doing more"

If I could do more, I did

If I could help more, I tried

If I could make things more fair and just,...

Then a friend quoted to me: "You are a human being, not a human doing"

So, I went diving.

From coral-covered wrecks in Egypt to the historical warships in Malta,

I dove to 65m, deeper than I had before, carrying 4 tanks of gas.

Drifting through hammerhead tornadoes & alongside whale sharks,

I remembered.

It all started when I was 6.

I read a biography of Marie Curie.

She said, “Nothing in life is to be feared, it is only to be understood. Now is the time to understand more, so that we may fear less.”

I wanted to be her.

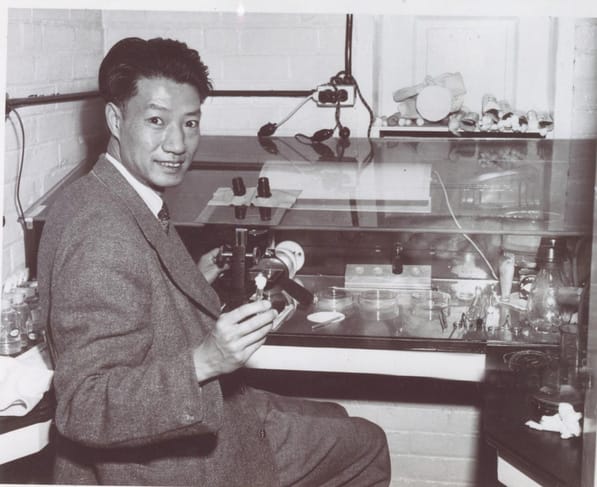

From 8th-12th grade, I spent the majority of my afterschool hours in labs.

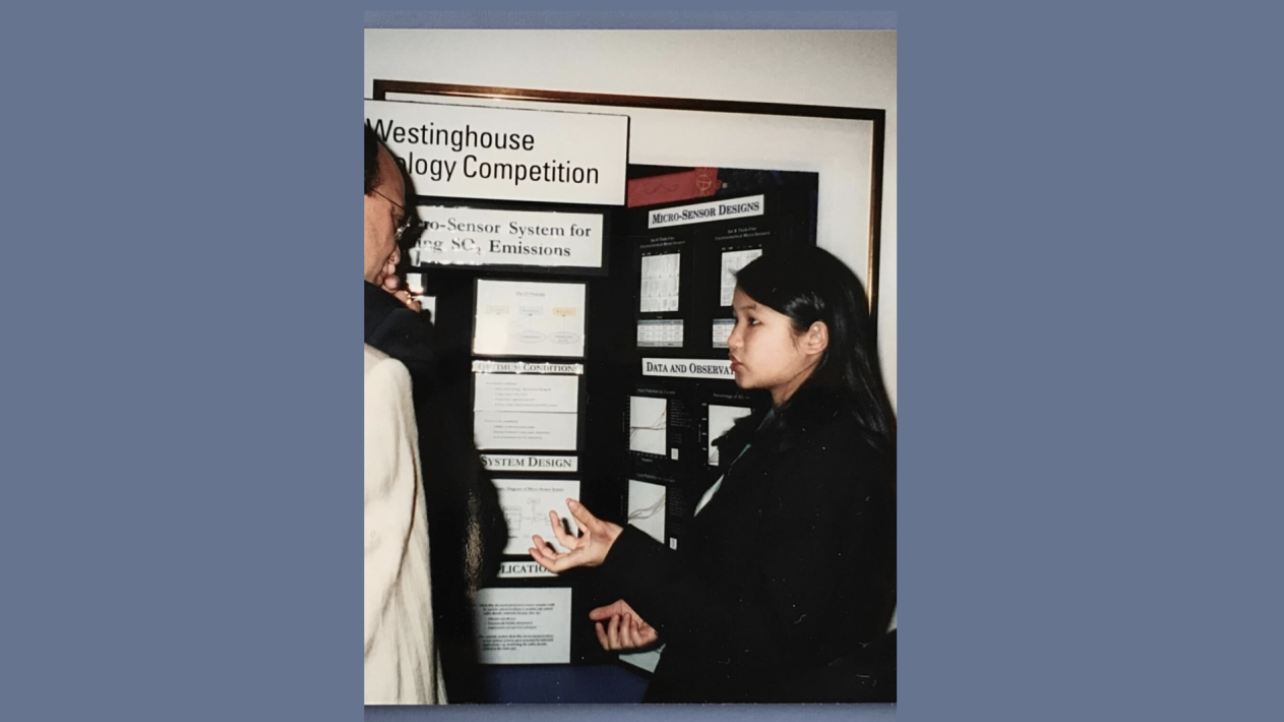

At 14, I invented a MEMS system for monitoring emissions for reducing acid rain.

At 16, I developed methodologies for mapping wildfire spread.

I loved science for what it could do & how it could change conversations, inspiring elegant solutions to complex problems.

By 25, I had 3 STEM degrees, including a PhD in microfluidics from Harvard.

I worked on projects from biotoxins to flexible electronics to shape memory alloys to aquatic biomechanics to lab-on-a-chip.

I helped teach 7yrs of chemistry & differential equations, developed interactive STEM courses, & mentored hundreds of high schoolers with science projects.

And I realized: With the changes in grant funding, the best discoveries were going to be privately funded again

I decided I needed to become a VC

So, I left academia -- To learn about this "venture capital thing"

First, I wanted to understand how to grow companies, as an operator. Leveraging analytics helped me develop monetization/growth strategies across sectors.

Then, I wanted to understand how to fund companies, as an investor.

Being in the trenches with founders led me to companies w real potential.

The argument has been that science isn't "venture backable"

Too much capital, too much time

But the acceleration of AI makes this all possible.

(Lots more on this in future posts)

In Oct, at a Research Science Institute (RSI) reunion, I was reminded of the amazing scientists building new tools, unlocking discoveries we need for the future.

Felt like a homecoming.

So, this is a long-winded way to say:

Here is Skeleton Key.

An amalgamation of all of my beings.

A culmination of all of my doings.

Follow us on LinkedIn, and subscribe here if you haven't already. Every week we'll bring you can’t miss stories from the front lines of science in a way you get, that matters to you, and will make you sound smart at parties. The future we always dreamt of is almost here. We will be updating subscribers weekly on the how, what, and why of our commitment to the realization and commercialization of technologies for accelerating scientific discoveries that unlock change in our day-to-day.